Although various factors affected the reduction, the reduction was mainly due to the expected withdrawal of federal funding for several programs and the approval of only a few new capital projects, which eliminated the need to draw down money from a revenue bond to support a larger number of projects

Yavapai Community College’s total revenue is projected to decline in the 2025–2026 draft budget. According to information presented to the District Governing Board at its April meeting, revenue is expected to fall from approximately $126.8 million in 2024–2025 to around $118.4 million in 2025–2026—a decrease of $8.4 million (6.6%).

Yavapai Community College’s total revenue is projected to decline in the 2025–2026 draft budget. According to information presented to the District Governing Board at its April meeting, revenue is expected to fall from approximately $126.8 million in 2024–2025 to around $118.4 million in 2025–2026—a decrease of $8.4 million (6.6%).

Although there are several factors that may affect the reduction, this revenue drop appears primarily to stem from a $2.3 million reduction in federal support and a $6.1 million decrease in new capital project funding. The decrease in capital projects meant that money was not needed to be taken from an existing $16 million revenue bond and added to the budget.

At this stage, the draft capital improvement budget includes only four new projects for the coming year, all located on the west side of Yavapai County, specifically at Prescott-area campuses and centers. The proposed projects include:

- $1,330,000 for upgrades to the Community Room on the Prescott Campus

- $45,000 for improvements at the Career and Technical Education Center (CTEC)

- $147,300 for renovations to the Prescott Campus cafeteria

- $28,500 for an EMS carport

Additionally, a contingency fund of $160,000 is included in the draft budget.

The final budget will be presented to the District Governing Board at the May 27 Budget Public Hearing and Adoption Business Meeting, where most anticipate it will receive approval.

The link below takes you to a video clip of the explanation given at the April Board meeting and may be helpful in further understanding the reduction. Please click here.

Ray Sigafoos is the longest serving member of the Yavapai Community College District Governing Board with 18 years of service. He is running once again for the position in November.

Ray Sigafoos is the longest serving member of the Yavapai Community College District Governing Board with 18 years of service. He is running once again for the position in November.

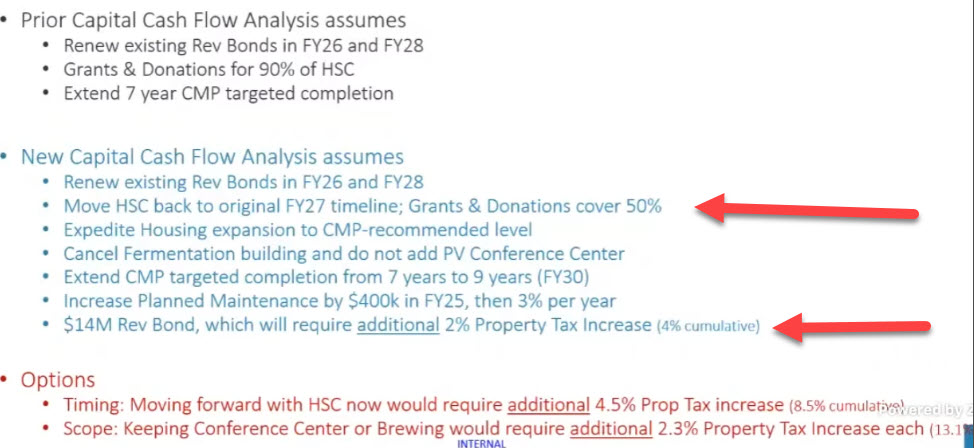

Yavapai Community College District one candidate William Kiel, while addressing the Governing Board at the May 21, 2024, public tax hearing, was unable to persuade its members to reject the 3.4 percent primary property tax increase it was considering. The property tax rate was approved by a 3-2 vote.

Yavapai Community College District one candidate William Kiel, while addressing the Governing Board at the May 21, 2024, public tax hearing, was unable to persuade its members to reject the 3.4 percent primary property tax increase it was considering. The property tax rate was approved by a 3-2 vote.

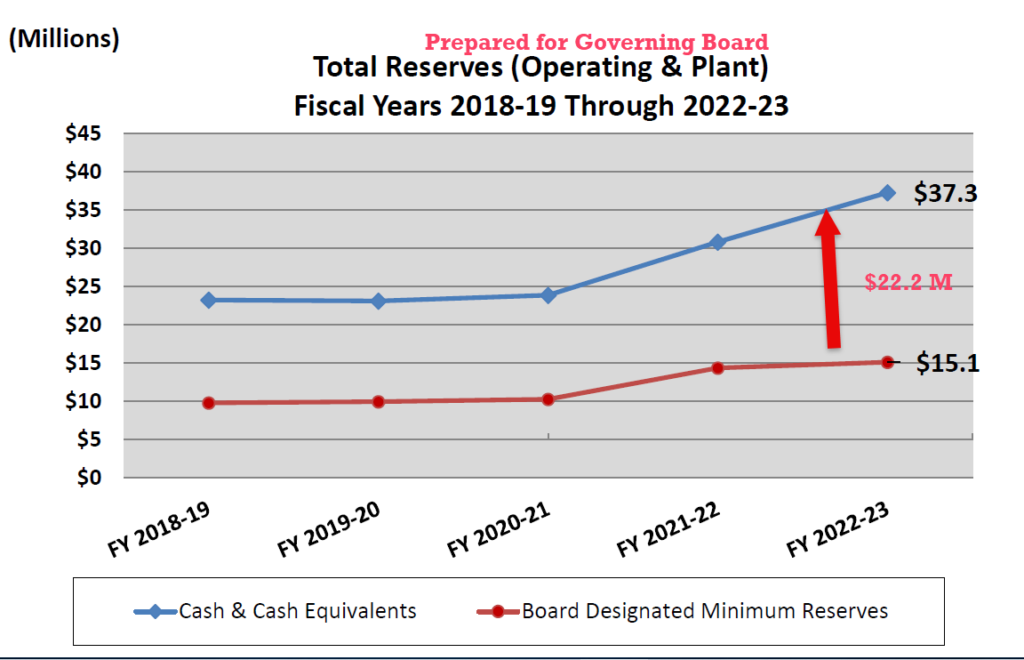

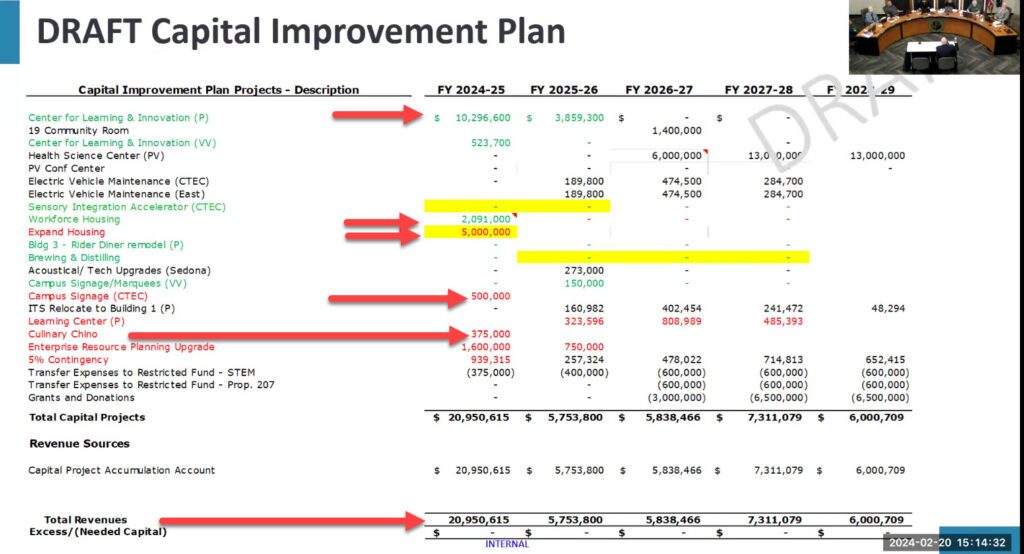

Dr. Clint Ewell, Vice President of Finance at Yavapai Community College, presented the cash flow requirements for the upcoming academic year during the February 2024 meeting of the District Governing Board. He explained the financial needs of the Community College, detailing the amount of additional funding required and the intended allocation within the 2024-2025 budget.

Dr. Clint Ewell, Vice President of Finance at Yavapai Community College, presented the cash flow requirements for the upcoming academic year during the February 2024 meeting of the District Governing Board. He explained the financial needs of the Community College, detailing the amount of additional funding required and the intended allocation within the 2024-2025 budget.

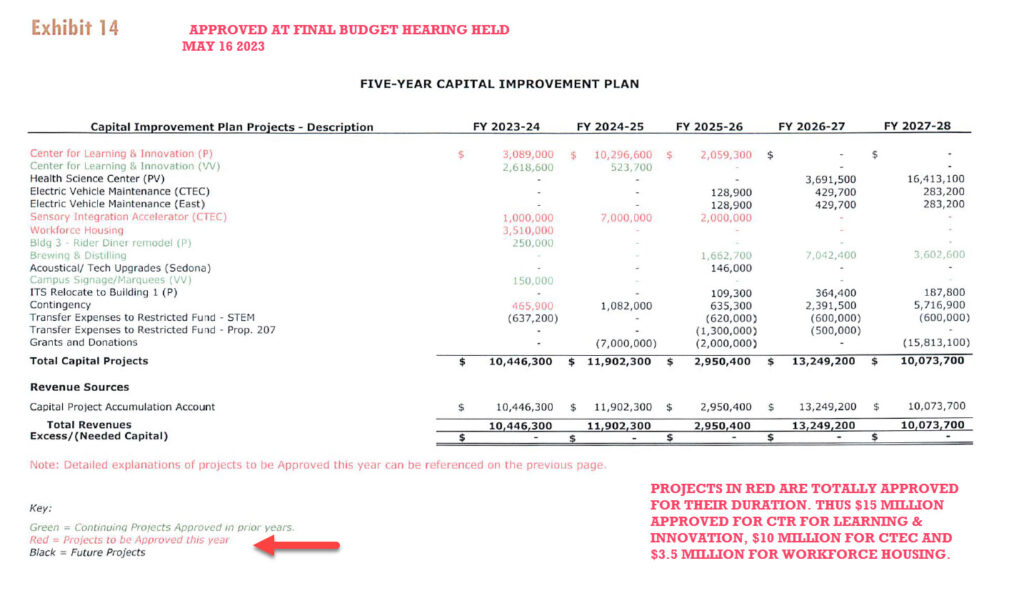

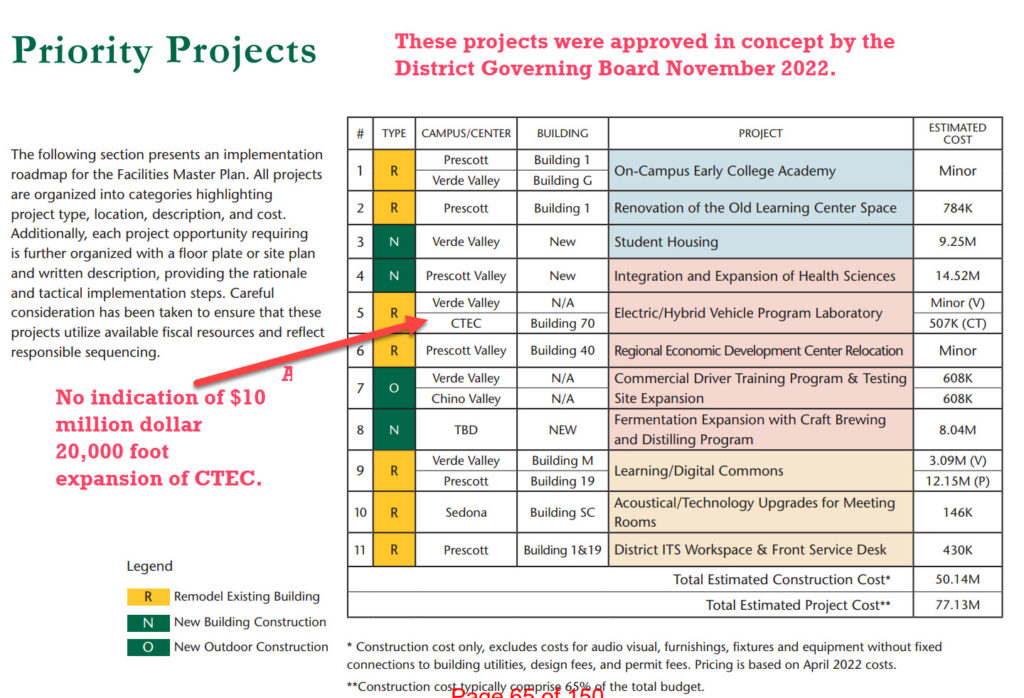

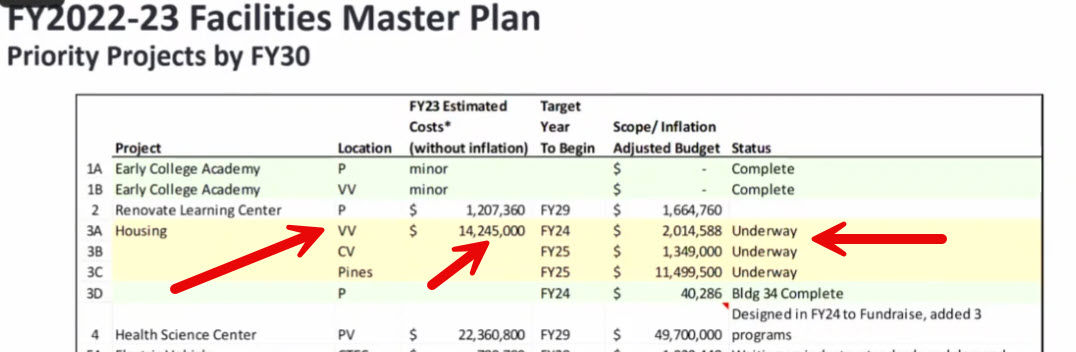

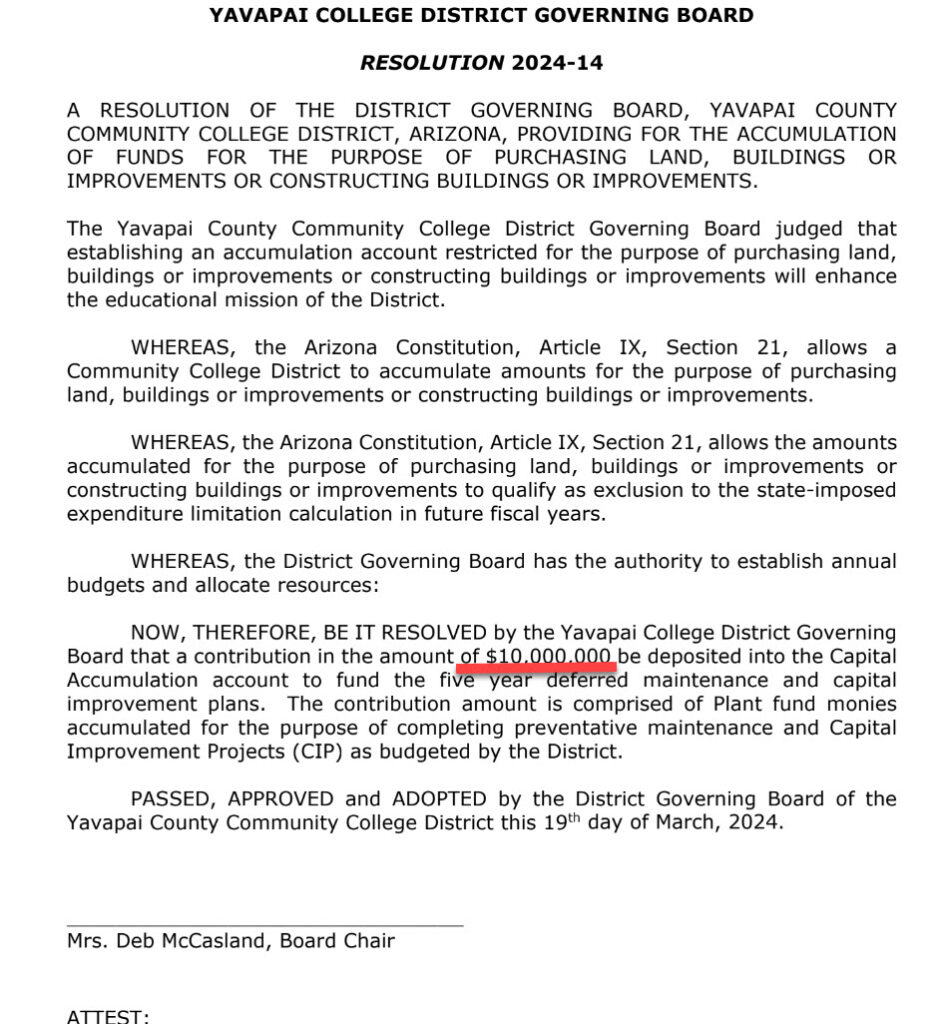

No explanations were provided prior to the May 2023 budget meeting supporting the sudden decision to increase the size of CTEC, especially considering that the College already possesses 108,000 square feet at that facility. Similarly, no clarifications were given at the meeting regarding why the specific amount of $10 million was chosen, nor was there any disclosure regarding the portion of funding that might come from state grants. Furthermore, it remained unclear whether the $10 million would be spent regardless of the availability of state funding.

No explanations were provided prior to the May 2023 budget meeting supporting the sudden decision to increase the size of CTEC, especially considering that the College already possesses 108,000 square feet at that facility. Similarly, no clarifications were given at the meeting regarding why the specific amount of $10 million was chosen, nor was there any disclosure regarding the portion of funding that might come from state grants. Furthermore, it remained unclear whether the $10 million would be spent regardless of the availability of state funding.