Figures issued by College suggest decline of $624,000 in tuition revenue in 2018 when compared to four years earlier despite tuition increases every year

The tuition data released by the Community College at the March 2019 Governing Board meeting should be worrying to the Governing Board and Administration. According to the data, the College took in about $624,000 less in tuition than it did four years ago. This is despite tuition increase in every year over the past decade.

The tuition data released by the Community College at the March 2019 Governing Board meeting should be worrying to the Governing Board and Administration. According to the data, the College took in about $624,000 less in tuition than it did four years ago. This is despite tuition increase in every year over the past decade.

According to the data, four years ago students on the west side of the County took 35,504 credit hours in the fall. However, in the 2017-18 academic year they took only 32,737, a decline of 2,767 credits. Students in the east region took in the same period took 8,900 credit hours four years earlier and 9,603 credit hours in the 2017-18 academic year; an increase of 703 credit hours. The net loss to the College in the fall was 2,064 credit hours.

In the spring semester four years ago, students on the west side of the County took 36,568 credit hours. However, in the 2017-18 spring semester they took only 32,345 credit hours. This was a decline of 4,225 credit hours. Students in the east region took 8,897 credit hours four years and 8,938 in the spring 2018. This is an increase of 41 credit hours. The net loss to the College in this period (4225 – 41 =.4,184.)

The overall loss of credit hours in 2018 when compared to four years earlier appears to be 6,248 credit hours. If these figures are correct, the Community College tuition revenue in the past academic year was down by $624,800 dollars when compared to four years earlier (using $100 tuition x 6248 credit hours) (tuition runs from $87, $100, $110, market).

A few years ago, the College announced it has lost about a million dollars in revenue from problems with enrolling students in its aviation program. The College has not recently reported the status of that program or compared it with years earlier. That information should be included in the next tuition report. It may have skewed this data, to some extent.

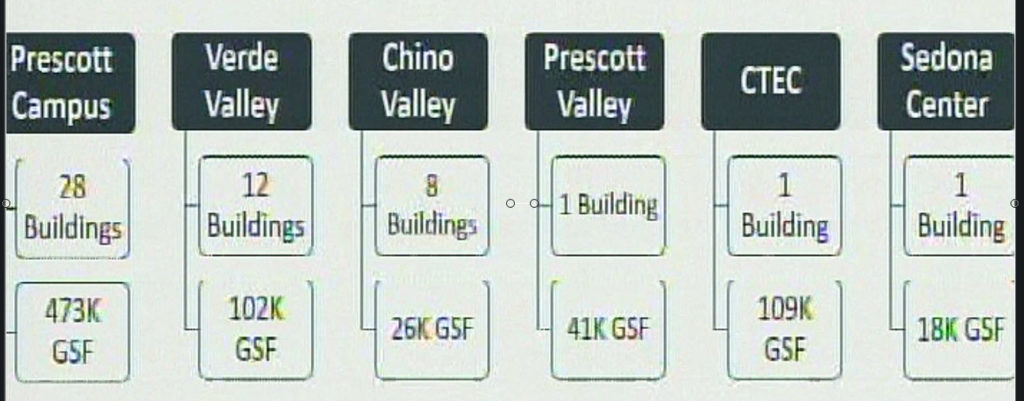

Dr. Ewell also reported that the consultants anticipated the College will need at least $32 million over the next ten years to ensure proper maintenance of the buildings on its campuses and centers in the District.

Dr. Ewell also reported that the consultants anticipated the College will need at least $32 million over the next ten years to ensure proper maintenance of the buildings on its campuses and centers in the District.

Second District Yavapai Community College representative Deb McCasland listed her concerns with the actions of the Governing Board at the May meeting in the Verde Independent newspaper “My Turn” column May 15. Among the many concerns was the majority on the Board essentially snubbing the public who spoke, all of whom opposed the increase. She wrote that it was difficult for her to understand “how the other board members can disregard the numerous comments from concerned citizens.”

Second District Yavapai Community College representative Deb McCasland listed her concerns with the actions of the Governing Board at the May meeting in the Verde Independent newspaper “My Turn” column May 15. Among the many concerns was the majority on the Board essentially snubbing the public who spoke, all of whom opposed the increase. She wrote that it was difficult for her to understand “how the other board members can disregard the numerous comments from concerned citizens.”

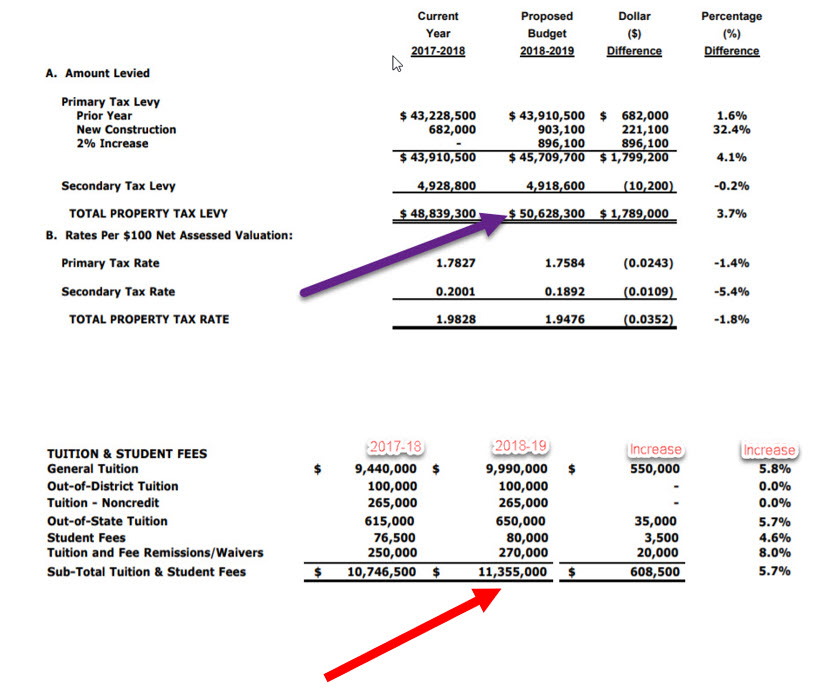

After surveying the Yavapai Community College Governing Board members at the April 2018 meeting, the College Administration has enough votes to increase the County property tax rate by at least 2%. In February 2018 the Board had voted 4-1 (McCasland dissenting) to increased tuition by 5%. The increases will generate at least $1,504,600 in new revenue flowing to the College.

After surveying the Yavapai Community College Governing Board members at the April 2018 meeting, the College Administration has enough votes to increase the County property tax rate by at least 2%. In February 2018 the Board had voted 4-1 (McCasland dissenting) to increased tuition by 5%. The increases will generate at least $1,504,600 in new revenue flowing to the College.