Highest form of recognition in governmental accounting and financial reporting

The Certificate of Achievement for Excellence in Financial Reporting has been Awarded to Yavapai County Community College District by Government Finance Officers Association of the United States and Canada (GFOA) for its comprehensive annual financial report (CAFR). The Certificate of Achievement is the highest form of recognition in the area of governmental accounting and financial reporting. Its attainment represents a significant accomplishment by a government and its management.

The CAFR has been judged by an impartial panel to meet the high standard s of the program, which includes demonstrating a constructive ”spirit of full disclosure” to clearly communicate its financial story and motivate potential users and user groups to read the CAFR.

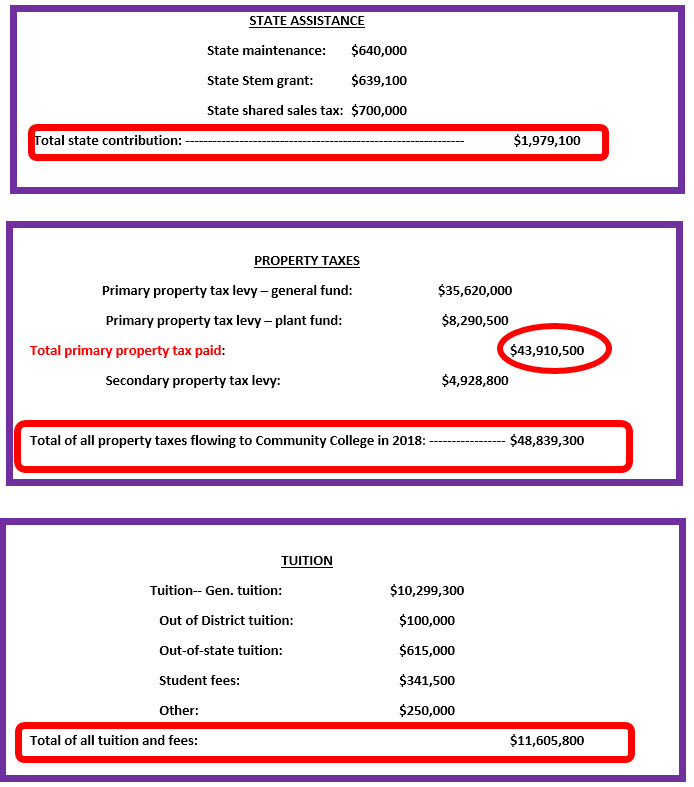

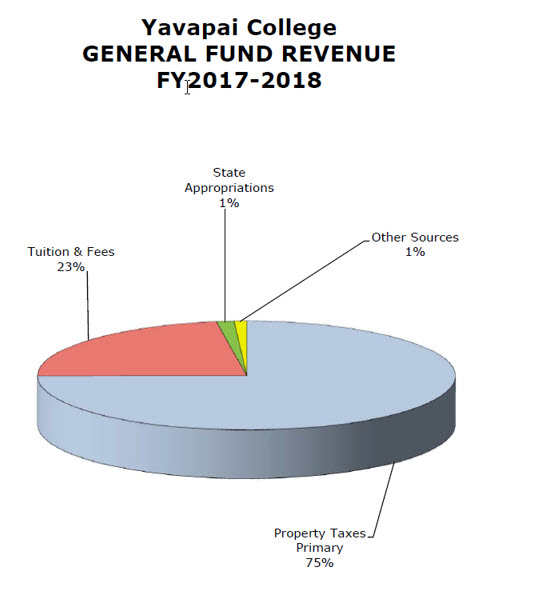

This is the information the Governing Board will have Tuesday, May 9, 2017 when the five County representatives vote on the 2017-18 College budget. If history is any indicator, the Budget will be rubber stamped by at least the West County voting bloc.

This is the information the Governing Board will have Tuesday, May 9, 2017 when the five County representatives vote on the 2017-18 College budget. If history is any indicator, the Budget will be rubber stamped by at least the West County voting bloc.