College says it can’t give financial information as requested because it doesn’t keep books so it can; reluctantly agrees to provide some estimates

For more than 20 years, the Yavapai Community College has functioned almost completely out of the public eye. Its administrators have been able to do whatever they chose to do with taxpayer funds with little or no question. Given this history, the administrators were no doubt shocked by the action of the Verde Valley Advisory Committee to the District Governing Board.

The Verde Valley Advisory Committee to the District Advisory Board has been trying to obtain the specific costs of operating the Sedona Center and the Verde Campus in Clarkdale with little success.

When the Committee asked for the information from Vice President Clint Ewell, he refused to provide it. He claimed that the financial records are not kept by the College in such a way as to provide the information the Committee was seeking.

When the Committee asked for the information from Vice President Clint Ewell, he refused to provide it. He claimed that the financial records are not kept by the College in such a way as to provide the information the Committee was seeking.

At the District Governing Board meeting on August 5, 3rd District Representative Al Filardo asked the Board if it would join him in asking Ewell for the information. During the discussion, which you can view by clicking here, Ewell again stated that he could not provide the details the Committee sought. However, he reluctantly agreed to provide some financial information based on “estimates” to the Committee.

The detailed financial data is viewed as operational and is kept closely guarded by the Administration. The budget it produces fails to provide any details regarding the costs of operating individual campuses. Ironically, it closed the Camp Verde facility in 2010 and tried to close and sell the Sedona Center in 2013 because of low enrollment and operating costs. Amazing how those costs seem to be at the fingertips of the administrators when they want to close something down in the Verde Valley.

Total staff cuts since 2012 came to 46. A total of 14 new positions have been created since then. This means that about 12/46 or 26% have been restored on campuses on the West side of the County. Two new positions are slated for the Verde Valley in 2016. She did not say how many new positions are slated for the West side of the County om 2016.

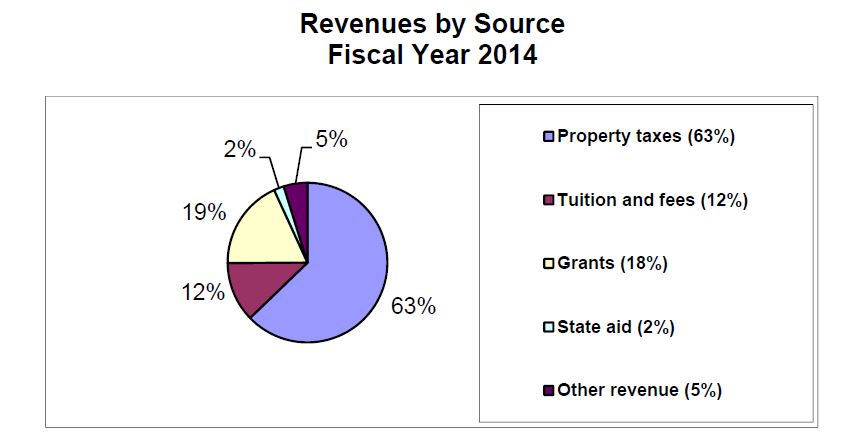

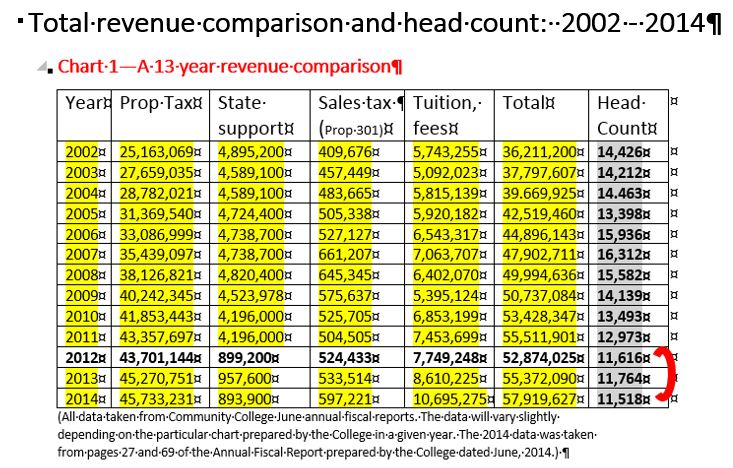

Total staff cuts since 2012 came to 46. A total of 14 new positions have been created since then. This means that about 12/46 or 26% have been restored on campuses on the West side of the County. Two new positions are slated for the Verde Valley in 2016. She did not say how many new positions are slated for the West side of the County om 2016. State support accounts for 2% of the total College budget. County property taxes and student tuition and fees account for the bulk of revenue coming to the College each year.

State support accounts for 2% of the total College budget. County property taxes and student tuition and fees account for the bulk of revenue coming to the College each year. Sources who the Blog believes are reliable tell it that the College will receive an additional $300,000 from the State of Arizona this coming year. That should be good news for Yavapai County taxpayers.

Sources who the Blog believes are reliable tell it that the College will receive an additional $300,000 from the State of Arizona this coming year. That should be good news for Yavapai County taxpayers. When asked to provide information regarding the number of lay-offs on the Verde Campus, the Administration said it did not have that information available at the meeting.

When asked to provide information regarding the number of lay-offs on the Verde Campus, the Administration said it did not have that information available at the meeting.

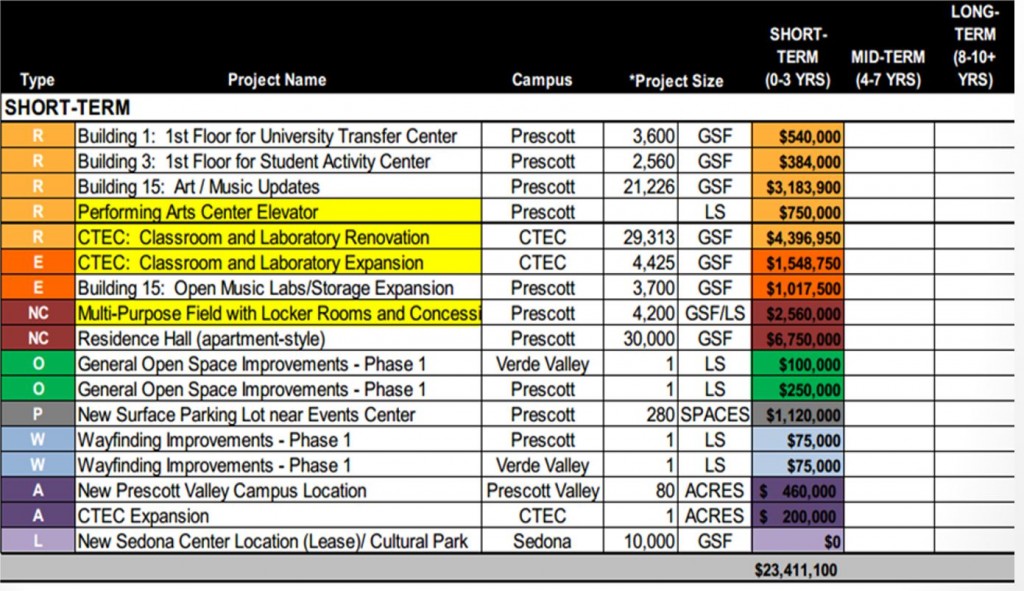

The General Obligation bonds are approved by voters and used for capital projects. The last time voters in Yavapai County approved General Obligation bonds was in the year 2000 when they approved issuance of $69.5 million dollars in bonds for the Community College.

The General Obligation bonds are approved by voters and used for capital projects. The last time voters in Yavapai County approved General Obligation bonds was in the year 2000 when they approved issuance of $69.5 million dollars in bonds for the Community College.