McCasland also votes to approve budget; Payne does not object but abstains on budget vote

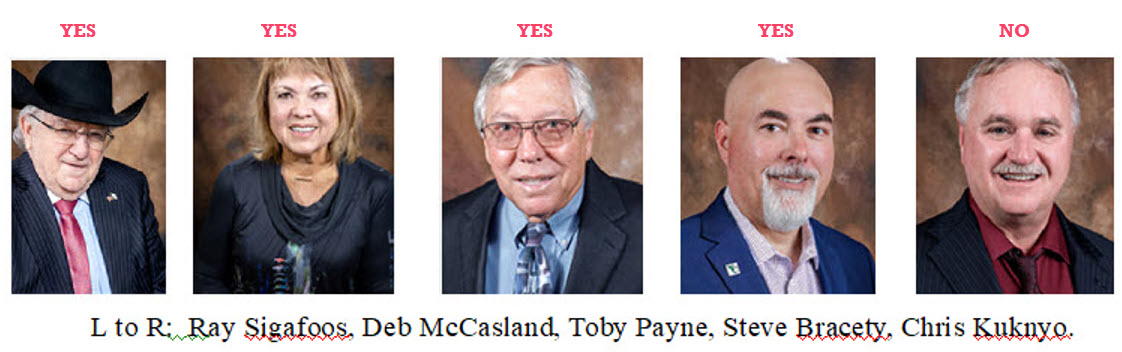

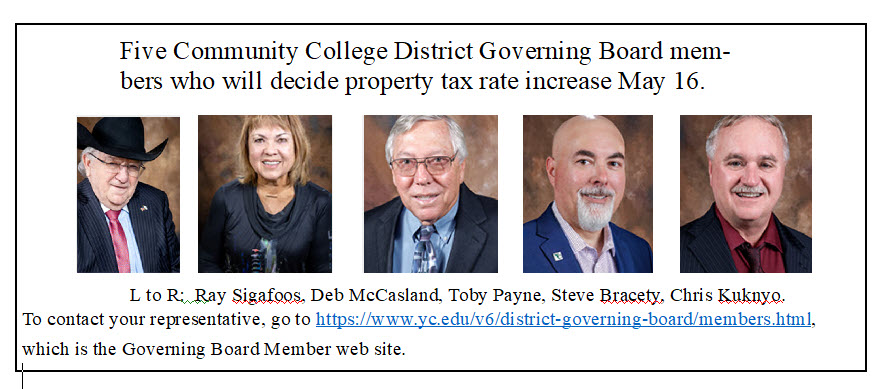

Both members of the Yavapai Community College District Governing Board who together represent Sedona and the Verde Valley voted to approve the requested five percent tax rate increase on primary property in Yavapai County at the Governing Board meeting May 16. Chair Deb McCasland also voted to approve the $101 million budget. Newly appointed District three representative Toby Payne did not oppose the capital budget but abstained.

Governing Board Chair Deb McCasland

Ms. McCasland represents District 2, which encompasses about half of her constituents and includes the following: Aqua Fria, Beaver Creek, Camp Verde 1 and 2, Canyon, Cherry Creek, Cordes Lakes, Cornville, Crown King, Humboldt, Mayer, Middle Verde, Montezuma, Prescott Country Club, Stoneridge, Sugarloaf and Verde Lakes.

Newly appointed Third District Representative Toby Payne

Mr. Payne represents District 3, which encompasses the following: Big Park, Bridgeport 1 and 2, Clarkdale, Clemenceau, Coffee Pot, Cottonwood, Fir, Jacks Canyon, Jerome 1 and 2, Mingus, Orchard, Quail Springs, Red Rock 1 and 2, Red Rock East, Red Rock West, Verde Village, Western, and Wild Horse. All his constitutes live in Sedona/Verde Valley.

Ms. McCasland explained her vote in favor of the tax increase, which explanation you can hear and see by clicking here.

Ms. McCasland’s vote was needed in order to pass the budget, which passed 3-1-1. She explained her vote in favor of the budget, which explanation you can hear and see by clicking here.

Mr. Payne explained his vote in favor of the tax increase, which explanation you can hear and see by clicking here.

Mr. Payne did not object to the capital budget but abstained. You can see and hear Mr. Payne’s statement for abstaining by clicking here.

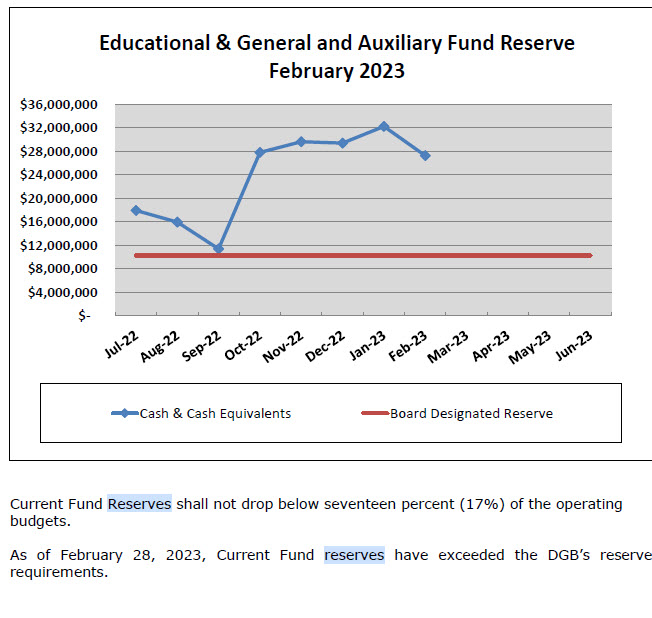

Yavapai Community College notified the District Governing Board at its October meeting that it will be seeking a primary property tax rate increase in May of 2023. It said that it needs more operating revenue and the only available source appears at present to be Yavapai County primary property taxpayers.

Yavapai Community College notified the District Governing Board at its October meeting that it will be seeking a primary property tax rate increase in May of 2023. It said that it needs more operating revenue and the only available source appears at present to be Yavapai County primary property taxpayers.  Last week, the Arizona attorney general sued Arizona State University(ASU) in Arizona Tax Court over a real estate deal approved by the Regents who oversee ASU.

Last week, the Arizona attorney general sued Arizona State University(ASU) in Arizona Tax Court over a real estate deal approved by the Regents who oversee ASU.  Accountant and local realtor Robb Witt says the 73,000 residents of East Yavapai County may be short-changed $12 million a year by Yavapai Community College. He arrived at his conclusion with the help of Tax Assessor Judd Simmons and budgetary material posted by the College.

Accountant and local realtor Robb Witt says the 73,000 residents of East Yavapai County may be short-changed $12 million a year by Yavapai Community College. He arrived at his conclusion with the help of Tax Assessor Judd Simmons and budgetary material posted by the College.

Clarkdale resident Kerry Olson expressed concern with Yavapai Community College raising taxes and providing “less services” in a letter to editor of the Verde Independent June 28, 2018 (online). She also asked about how the revenue from the sale of wine was being used.

Clarkdale resident Kerry Olson expressed concern with Yavapai Community College raising taxes and providing “less services” in a letter to editor of the Verde Independent June 28, 2018 (online). She also asked about how the revenue from the sale of wine was being used. Second District Yavapai Community College representative Deb McCasland listed her concerns with the actions of the Governing Board at the May meeting in the Verde Independent newspaper “My Turn” column May 15. Among the many concerns was the majority on the Board essentially snubbing the public who spoke, all of whom opposed the increase. She wrote that it was difficult for her to understand “how the other board members can disregard the numerous comments from concerned citizens.”

Second District Yavapai Community College representative Deb McCasland listed her concerns with the actions of the Governing Board at the May meeting in the Verde Independent newspaper “My Turn” column May 15. Among the many concerns was the majority on the Board essentially snubbing the public who spoke, all of whom opposed the increase. She wrote that it was difficult for her to understand “how the other board members can disregard the numerous comments from concerned citizens.”