Editor slams West County Voting-Bloc for “happily” rubber-stamping proposal to increase Taxes

Christoper Fox Graham

In an editorial of Wednesday, May 16, 2018, the managing editor of the Cottonwood Journal Extra, Christopher Fox Graham, slammed the three members of the Yavapai Community College Governing Board who approved the tax rate increase at the Board’s May meeting. The rate increase will generate an estimated $896,100 annually. Those members voting for the proposal were Steve Irwin, Pat McCarver, and Chairman Ray Sigafoos. East County representatives Deb McCasland and Connie Harris voted against the increase. McCasland provided several reasons for her opposition to the rate increase. Harris did not explain why she opposed the rate increase.

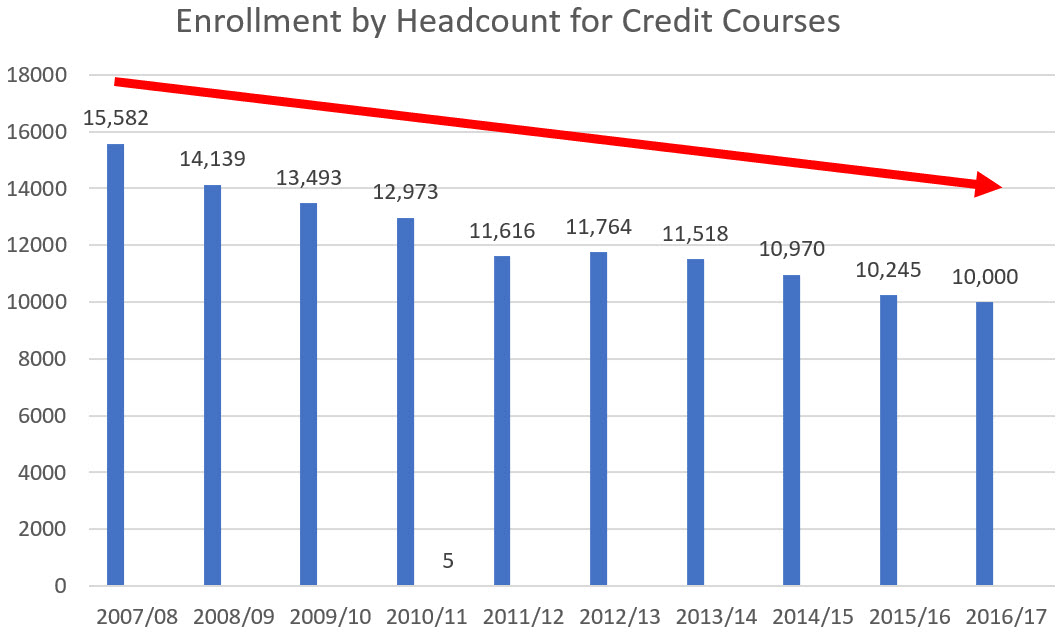

Graham argued that merely reopening the Sedona Center with two programs hardly justified the increase. He pointed out that the residents on the East side of the County have been battling for years for a return of the tax revenue they give the College that is retained for building projects on the West side.

Graham also asked: “Why would the College need to bilk taxpayers yet again for this paltry amount ($896,100) when it just got $4.4 million from the town of Prescott Valley for the sale of some college-owned property?”

“Fortunately, Wills announced she will be retiring at the end of the calendar year,” wrote Mr. Graham. Adding insult to injury, the Board voted 4-1 (McCasland dissenting) to give Wills a $3,000 bonus. Graham commented that “if you’re wondering where increased taxes are going, they’ll be heading to Wills ‘personal bank account.

You may read Mr. Graham’s editorial when it is posted on line at the following site (click here).

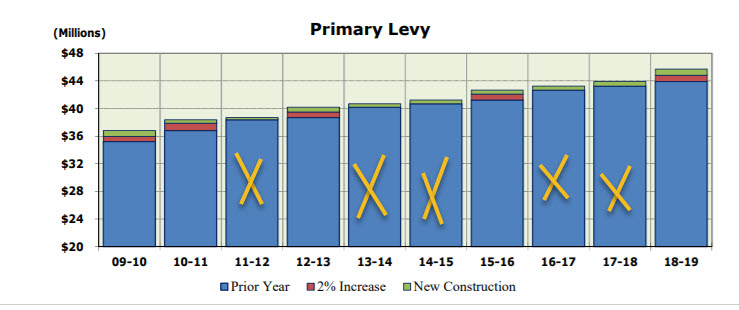

This was the fifth primary tax rate increase approved by the Governing Board the last 10 years. The last increase was approved by the West County Voting-Bloc in 2015. At that time, both East County representatives voted against the tax increase.

This was the fifth primary tax rate increase approved by the Governing Board the last 10 years. The last increase was approved by the West County Voting-Bloc in 2015. At that time, both East County representatives voted against the tax increase. The Yavapai Community College Governing Board will hold a series of tax and budget hearings beginning at 10:30 AM, Tuesday, May 8, 2018. The meetings will be held in building 19 – 147, which is a change from the normal location of meetings on the Prescott Campus.

The Yavapai Community College Governing Board will hold a series of tax and budget hearings beginning at 10:30 AM, Tuesday, May 8, 2018. The meetings will be held in building 19 – 147, which is a change from the normal location of meetings on the Prescott Campus.

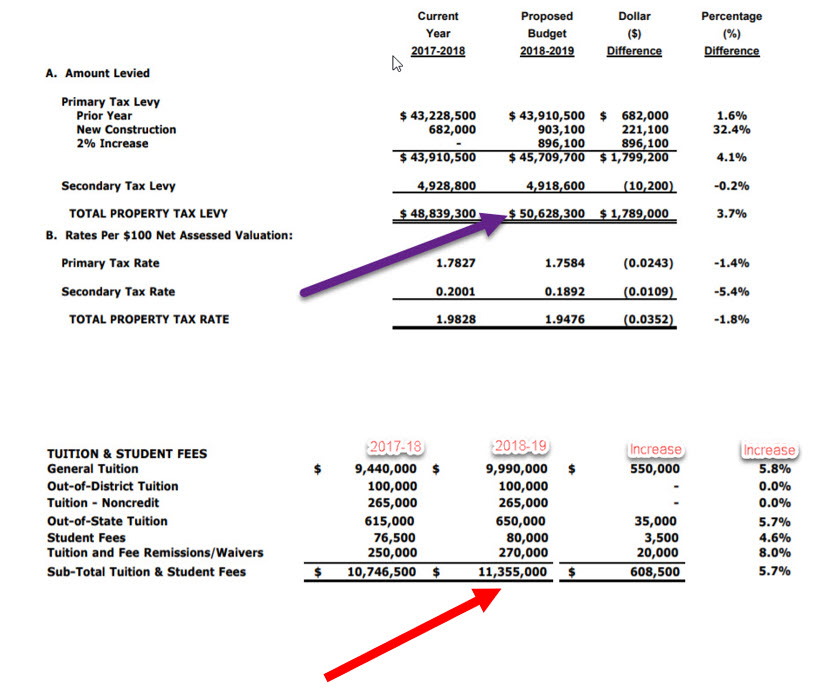

After surveying the Yavapai Community College Governing Board members at the April 2018 meeting, the College Administration has enough votes to increase the County property tax rate by at least 2%. In February 2018 the Board had voted 4-1 (McCasland dissenting) to increased tuition by 5%. The increases will generate at least $1,504,600 in new revenue flowing to the College.

After surveying the Yavapai Community College Governing Board members at the April 2018 meeting, the College Administration has enough votes to increase the County property tax rate by at least 2%. In February 2018 the Board had voted 4-1 (McCasland dissenting) to increased tuition by 5%. The increases will generate at least $1,504,600 in new revenue flowing to the College.

It is of interest that when Yavapai Community College released its press report explaining what took place at the January 16, 2018 Governing Board meeting there was no mention of Wills’ request for a 4% tax rate hike (or 5% tuition increase). But for the Blog and the videotape of the meeting, Yavapai residents would be completely in the dark about her tax rate request. As of this date, there have been no local newspaper accounts of the tax rate request and the Governing Board reaction to it.

It is of interest that when Yavapai Community College released its press report explaining what took place at the January 16, 2018 Governing Board meeting there was no mention of Wills’ request for a 4% tax rate hike (or 5% tuition increase). But for the Blog and the videotape of the meeting, Yavapai residents would be completely in the dark about her tax rate request. As of this date, there have been no local newspaper accounts of the tax rate request and the Governing Board reaction to it.