Unfortunately, College spends only $7.5 million — not $24 million — in the Verde Valley leaving millions on the table for West County use

A new in-depth financial estimate conducted by accountant and realtor Mr. Rob Witt suggests that the Verde Valley (including Sedona) as equity owners of the College should receive about $24 million annually for development, maintenance, and operations of the Verde Campus in Clarkdale and the Sedona Center. He says that the Blog report showing that the Verde Valley property taxpayers provide $14.7 million in property taxes is correct. However, he argues that this figure is far below what the Valley taxpayers should receive as equity owners in the College. He puts that figure at $24 million.

Recall that the College annually collects $14.7 million in property taxes in the Verde Valley and there is general agreement the College spends only $7.5 million of that money in the Verde Valley. This leaves $7.2 million left over in property taxes alone. (Note that over a two-year period 2016-17 the College invested about $2.5 to $3 million in capital improvements in each of those two years to renovate the Sedona Center.) Mr. Witt points out that there are millions of dollars in non-property tax revenue flowing to the College that are generated by Verde Valley students and families such as tuition, state aid, federal aid, grants and gifts.

Here is Mr. Witt’s equity argument: “When you summarize the property tax estimate from the East Valley, the Blog’s percentage is correct, however, by leaving off the East Valley’s percent of other revenue sources the Blog is significantly undervaluing the East Valley contribution. From an accounting standpoint, I look at the College budget like equity ownership. East County taxes fund 30% of the College Special District. This equates to 30% of the revenues and 30% of the expenses. The budget revenue is $82 million so the East County’s return should be 30% of that figure or $24 million.”

Mr. Witt has written to the College asking for a response to his detailed analysis with a spreadsheet in support of it. His spreadsheet is not included in this Blog. So far, he has not heard from the College.

It is of interest that when Yavapai Community College released its press report explaining what took place at the January 16, 2018 Governing Board meeting there was no mention of Wills’ request for a 4% tax rate hike (or 5% tuition increase). But for the Blog and the videotape of the meeting, Yavapai residents would be completely in the dark about her tax rate request. As of this date, there have been no local newspaper accounts of the tax rate request and the Governing Board reaction to it.

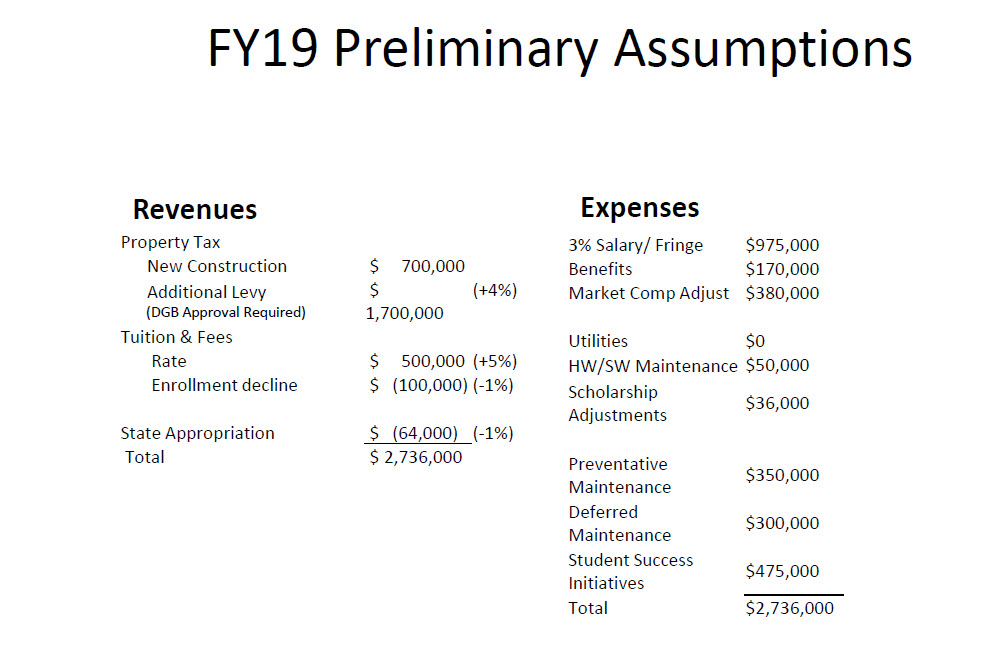

It is of interest that when Yavapai Community College released its press report explaining what took place at the January 16, 2018 Governing Board meeting there was no mention of Wills’ request for a 4% tax rate hike (or 5% tuition increase). But for the Blog and the videotape of the meeting, Yavapai residents would be completely in the dark about her tax rate request. As of this date, there have been no local newspaper accounts of the tax rate request and the Governing Board reaction to it. The Wills’ administration, in preliminary talks about the 2018-19 budget at the Governing Board meeting on Tuesday, January 16, sought large increases in revenue flowing to the College. The Administration suggested a four percent increase in the Yavapai County Property Tax rate. It also suggested a five percent student tuition increase for 2018-19.

The Wills’ administration, in preliminary talks about the 2018-19 budget at the Governing Board meeting on Tuesday, January 16, sought large increases in revenue flowing to the College. The Administration suggested a four percent increase in the Yavapai County Property Tax rate. It also suggested a five percent student tuition increase for 2018-19. The fiscal year for the College ended June 30, 2017. This is the detailed information given the Governing Board about its financial and enrollment situation when it ended the fiscal year in June 2017. It is worth reviewing as we close out the calendar year 2017.

The fiscal year for the College ended June 30, 2017. This is the detailed information given the Governing Board about its financial and enrollment situation when it ended the fiscal year in June 2017. It is worth reviewing as we close out the calendar year 2017.

Because College has so many millions of dollars paid in by taxpayers annually, there was no need for any bonding needed to provide $17 million for these capital projects. As this blog has repeatedly told its readers, the college is flush with revenue. Furthermore, in the opinion of the blog, there is little serious oversight over how these millions are spent each year after basic educational expenses are met.

Because College has so many millions of dollars paid in by taxpayers annually, there was no need for any bonding needed to provide $17 million for these capital projects. As this blog has repeatedly told its readers, the college is flush with revenue. Furthermore, in the opinion of the blog, there is little serious oversight over how these millions are spent each year after basic educational expenses are met.