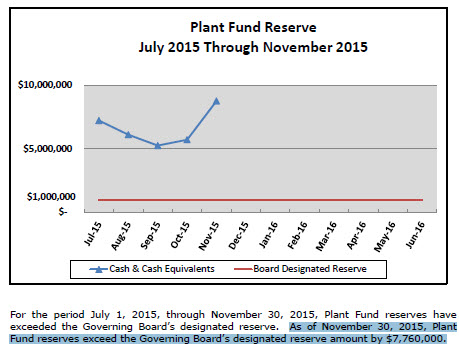

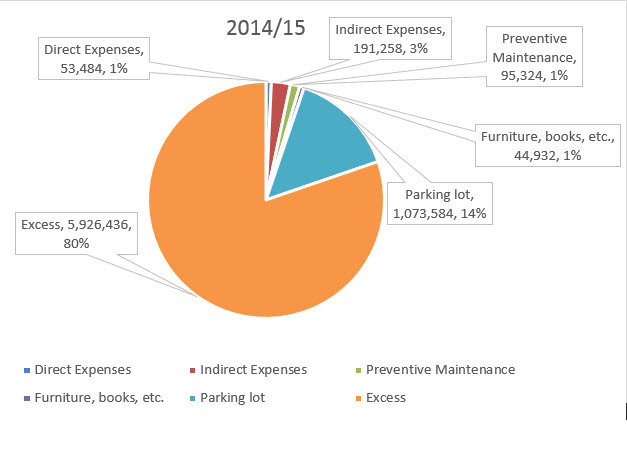

ENDS BUDGETED YEAR WITH OVER $5 MILLION IN UNSPENT FUNDS

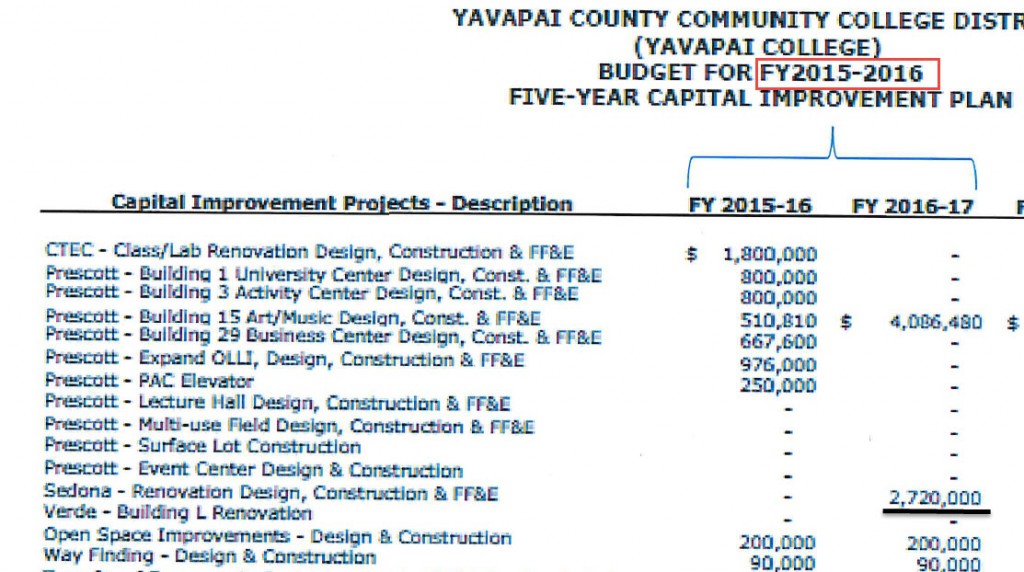

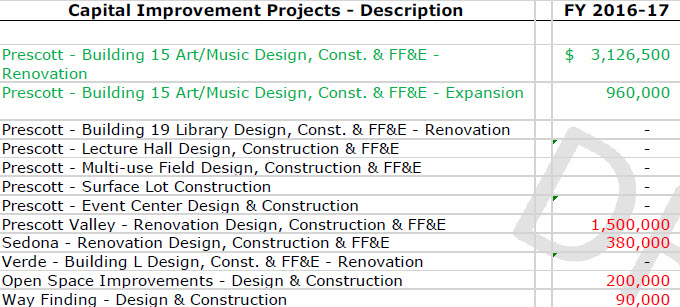

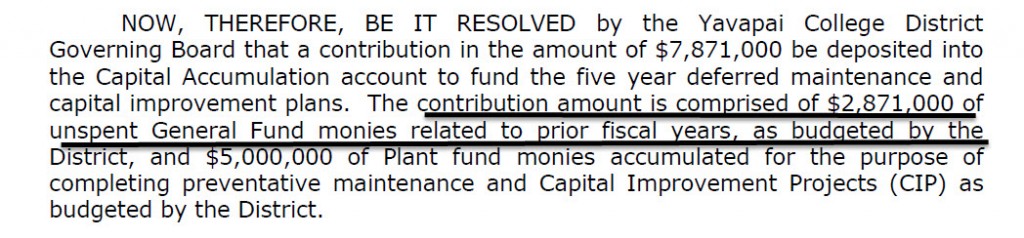

The College Administration will report to the Governing Board at its meeting on Tuesday, August 9, 2016 that it ended the 2015-16 (twelve months ended June 30, 2016) academic year with over $5 million dollars in surplus revenue. This is revenue that was budgeted but not spent in the 2015-16 budget.

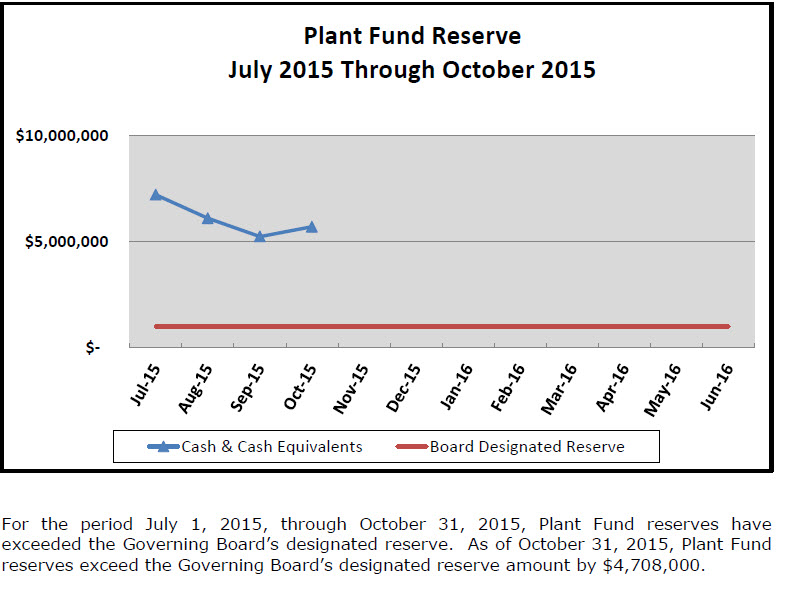

The College Administration will report excess revenue in the General Fund Budget of $2,208,713. It will also report revenue in the Unexpended Plant Fund in excess of $2,770,000. Finally, it will report excess revenue in the Auxiliary budget of $123,621.

The College Administration will report excess revenue in the General Fund Budget of $2,208,713. It will also report revenue in the Unexpended Plant Fund in excess of $2,770,000. Finally, it will report excess revenue in the Auxiliary budget of $123,621.

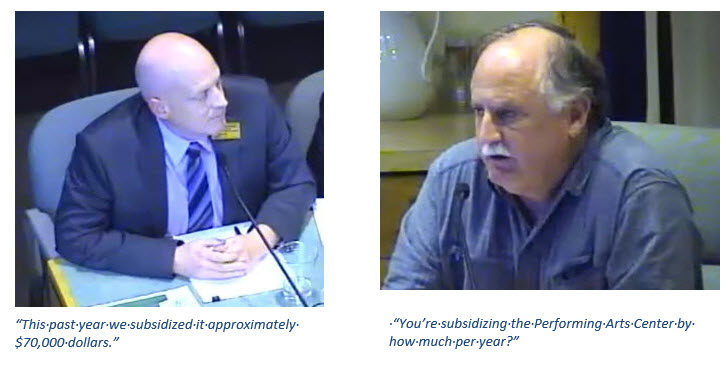

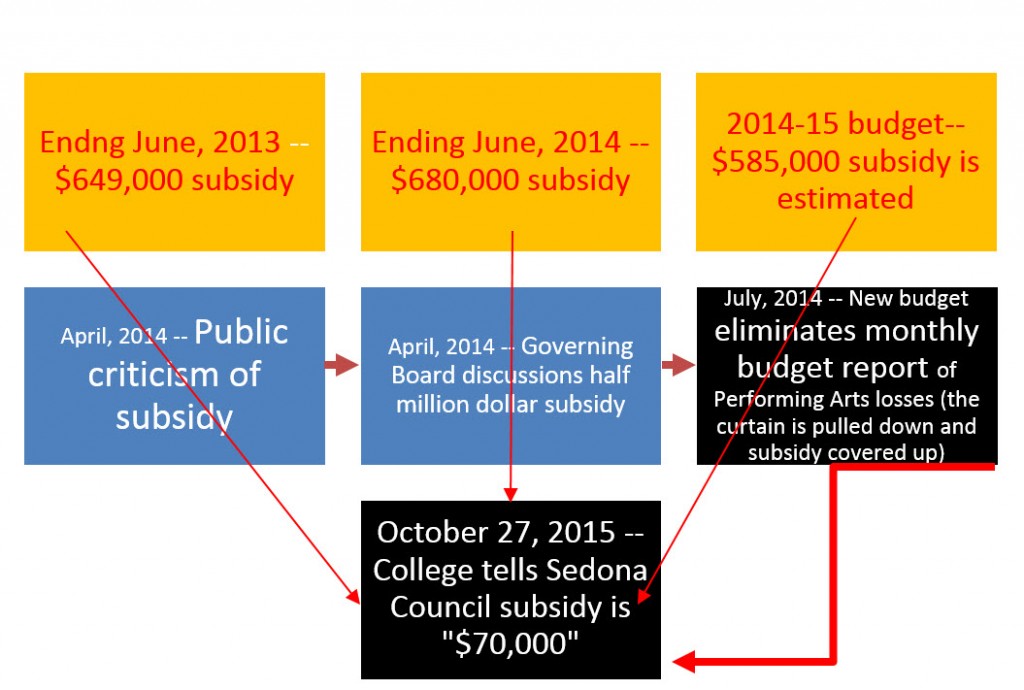

Given all the excess revenue, why did it demand in June, 2016 a fee barrier be erected for qualified students in the County-wide dual enrollment program? Recall that in June, 2016 the College indicated it needed to assess a per credit fee on qualified high school students taking dual enrollment classes and got the Governing Board to approve the increase so it could get around $100,000 in new revenue from the high schools.

Also recall that in presenting its request for a per credit fee for the dual enrollment program in December, 2015 and January, 2016 it never mentioned a budgetary need. By the way, the new fee imposed by the College may prevent poor high school students from taking dual enrollment courses. The College does not seem to care.

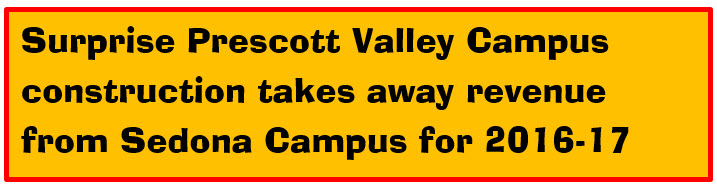

The only conclusion one can reach is that the priorities of this Administration are on buildings; not education.

The article made the following points:

The article made the following points: