McCasland, Sigafoos & McCarver voice concerns with Wills’ request; Harris and Irwin silent

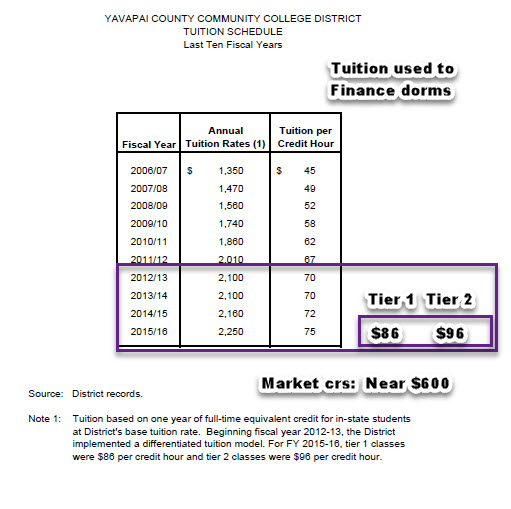

The Wills’ administration, in preliminary talks about the 2018-19 budget at the Governing Board meeting on Tuesday, January 16, sought large increases in revenue flowing to the College. The Administration suggested a four percent increase in the Yavapai County Property Tax rate. It also suggested a five percent student tuition increase for 2018-19.

The Wills’ administration, in preliminary talks about the 2018-19 budget at the Governing Board meeting on Tuesday, January 16, sought large increases in revenue flowing to the College. The Administration suggested a four percent increase in the Yavapai County Property Tax rate. It also suggested a five percent student tuition increase for 2018-19.

The suggested increases did not go down well with at least three members of the Board. Board members Deb McCasland (Verde Valley/West side), Ray Sigafoos (Prescott) and Pat McCarver (Chino Valley) all indicated concern with the either the tax rate or tuition or both. Sigafoos seemed particularly concerned about the tax rate increase. He suggested the Administration go back to the drawing board and return with a more reasonable proposal.

Third District Verde Valley Representative Connie Harris and Prescott Valley Representative Steve Irwin said nothing.

The proposal by the Wills administration is a preliminary one. In February the first serious test of the recommendation will come when the Board sets tuition for the 2018-19 academic year. The tax rate decision will come after that with a final decision in May or June 2018.

With total primary tax-based revenue in 2012 flowing to the College from Yavapai County property taxpayers of $43,701,144.00, this means the Sedona Taxing District alone contributed at least 15 percent of the revenue toward operating the College.

With total primary tax-based revenue in 2012 flowing to the College from Yavapai County property taxpayers of $43,701,144.00, this means the Sedona Taxing District alone contributed at least 15 percent of the revenue toward operating the College. Third District Community College Al Filardo presented compelling reasons in opposition to a 2% increase in the County property tax at the June 9 District Governing Board meeting. Unfortunately, the three members on the West (Prescott) side of the Mountain rejected his carefully thought out position. Among the reasons Filardo opposed an increased property tax were the following:

Third District Community College Al Filardo presented compelling reasons in opposition to a 2% increase in the County property tax at the June 9 District Governing Board meeting. Unfortunately, the three members on the West (Prescott) side of the Mountain rejected his carefully thought out position. Among the reasons Filardo opposed an increased property tax were the following:

“We participate with and support the recommendations of the Verde Valley Board Advisory Committee created by the Yavapai College District Governing Board. We thank you for this avenue of communication and request that you accept the committee’s recommendations.”

“We participate with and support the recommendations of the Verde Valley Board Advisory Committee created by the Yavapai College District Governing Board. We thank you for this avenue of communication and request that you accept the committee’s recommendations.” During the past five decades, the success of the Prescott fundraising scheme has been phenomenal. Sedona and Verde Valley taxes have been used to build two campuses, dormitories, athletic fields, a professional tennis court, a basketball arena, indoor swimming complex, and a huge dinner theatre seating over 1,000. All on the West side of the County!

During the past five decades, the success of the Prescott fundraising scheme has been phenomenal. Sedona and Verde Valley taxes have been used to build two campuses, dormitories, athletic fields, a professional tennis court, a basketball arena, indoor swimming complex, and a huge dinner theatre seating over 1,000. All on the West side of the County!