Retired school superintendent wants taxes paid for Community College in Verde Valley to remain there

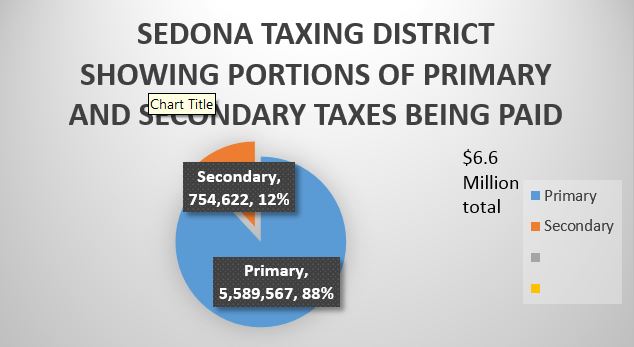

Retired Cottonwood-Oak Creek School District superintendent, Mrs. Julie Larson, expressed the views of most residents in the Verde Valley in an editorial in the May 27 Verde Independent. She stated she opposed the 2% property tax increase that will be voted on June 9 by the Yavapai College District Governing Board and wanted property taxes paid by Valley residents to remain in the Valley.

Larson wrote: “Sadly, the direction Yavapai College has taken in recent years has caused me to agree with a growing number of our community members that it is now time to take control over how our property taxes are utilized.”

Larson wrote: “Sadly, the direction Yavapai College has taken in recent years has caused me to agree with a growing number of our community members that it is now time to take control over how our property taxes are utilized.”

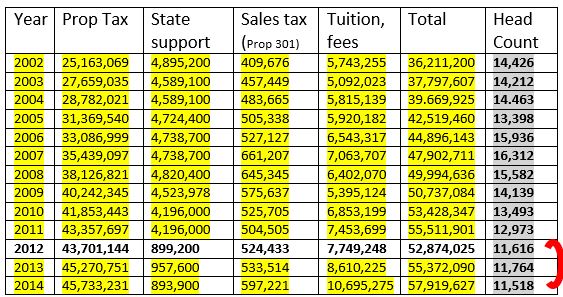

She continued: “Yavapai College is not held to the same financial restrictions that our local schools experience. The governing board of the college can simply vote to increase property taxes rather going to the voters for approval. Against the recommendation of the Verde Valley Advisory Committee, it now appears that the college board will follow administration’s recommendation to increase the property taxes by 2 percent. This is the sixth time in the last 10 years that property taxes for the community college have been increased. It also comes on the heels of a 4-percent tuition hike approved in February.”

Mrs. Larson’s complete editorial in the Verde Independent can be found by clicking here.

The Wills’ administration will do a lot of serious arm twisting to ensure it gets the tax increase at the Governing Board Work Session to be held next Tuesday, May 19 on the Prescott Campus in Building 32, room 119. If successful, the Board will vote to approve the property tax increase at its June meeting and taxpayers will have no recourse to challenge the decision. The meeting can also be seen and heard on the Verde Valley Campus, room G-103 (video conf).

The Wills’ administration will do a lot of serious arm twisting to ensure it gets the tax increase at the Governing Board Work Session to be held next Tuesday, May 19 on the Prescott Campus in Building 32, room 119. If successful, the Board will vote to approve the property tax increase at its June meeting and taxpayers will have no recourse to challenge the decision. The meeting can also be seen and heard on the Verde Valley Campus, room G-103 (video conf). It’s not clear whether the surprise announcement of the secret meeting to be held Wednesday at noon by the District Governing Board is a tax stunt or a serious effort to develop the Yavapai Community College in the Verde Valley. All that is known at this time is that the Board is to meet in secret at noon to discuss the purchase of some property somewhere in the Verde Valley.

It’s not clear whether the surprise announcement of the secret meeting to be held Wednesday at noon by the District Governing Board is a tax stunt or a serious effort to develop the Yavapai Community College in the Verde Valley. All that is known at this time is that the Board is to meet in secret at noon to discuss the purchase of some property somewhere in the Verde Valley.  The Committee vote against raising property taxes at this time was initially sparked for discussion and action when Committee members heard the College administration state during the March District Board meeting in Sedona that it was going to recommend a 2% property tax increase in property taxes.

The Committee vote against raising property taxes at this time was initially sparked for discussion and action when Committee members heard the College administration state during the March District Board meeting in Sedona that it was going to recommend a 2% property tax increase in property taxes.

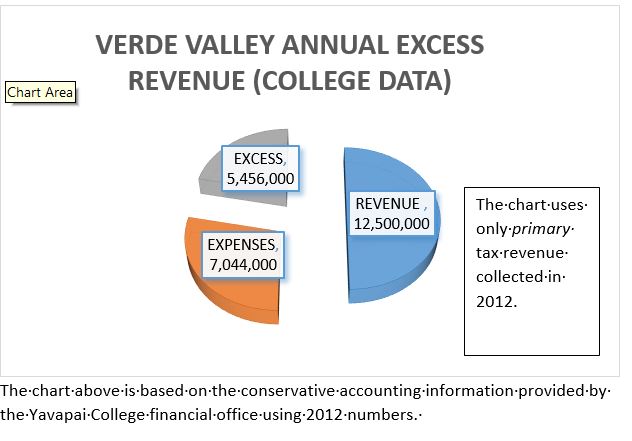

The College seeks the money so it can continue financing the construction projects it has decided are needed with about 90% or more of them on the West side of the County. Several are already in progress.

The College seeks the money so it can continue financing the construction projects it has decided are needed with about 90% or more of them on the West side of the County. Several are already in progress.