Another reason property tax increase was not warranted

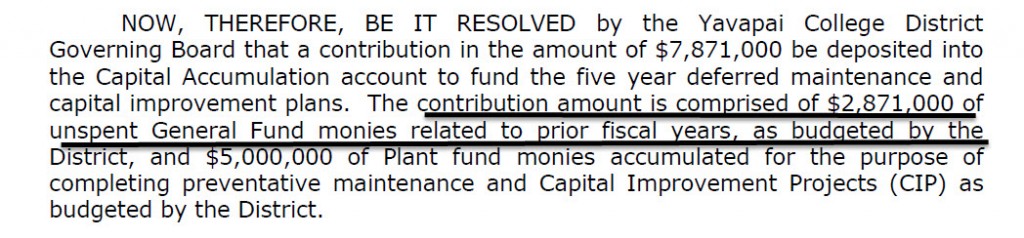

Thanks to Board Representative Deb McCasland, we now know much more about where the College is getting all the money to fund its multi-million dollar building program. The newest discovery of a source of revenue came during the February 9 District Governing Board meeting. At that meeting Ms. McCasland was unwilling to let a resolution transferring almost $2.9 million from the general revenue fund to the Capital Accumulation account as a part of the “consent agenda” pass without question. Consent agenda items are usually approved without discussion and Ms. McCasland asked that this item be pulled from the consent agenda. The Capital Accumulation account is used to pay for construction projects.

While questioning Vice President Clint Ewell, Ms. McCasland discovered that the policy of the current administration, and one followed for at least the last seven years, is to take any budgeted but unspent year-end revenue in the General Fund and put it into the Capital Accumulation account, where it is used for capital projects.

The fact that there was $2.9 million excess revenue not needed to meet items in the 2014-15 general budget was not disclosed to the Governing Board in June, 2015 when the College administration asked for a property tax increase. Had it been disclosed, or a reasonable estimate of the unspent revenue provided the Governing Board, it is hard to believe that the three-member West County block of representatives would have supported the request to increase taxes.

The brief discussion in response to Ms. McCasland’s inquiry can be viewed by clicking here.